TLDRs;

Contents

- Meta refuses to further revise its ad model, risking heavy EU fines.

- The company views regulatory penalties as manageable compared to changing its business structure.

- The EU argues Meta’s model violates user consent under the Digital Markets Act.

- This battle could set a precedent for future enforcement against tech giants.

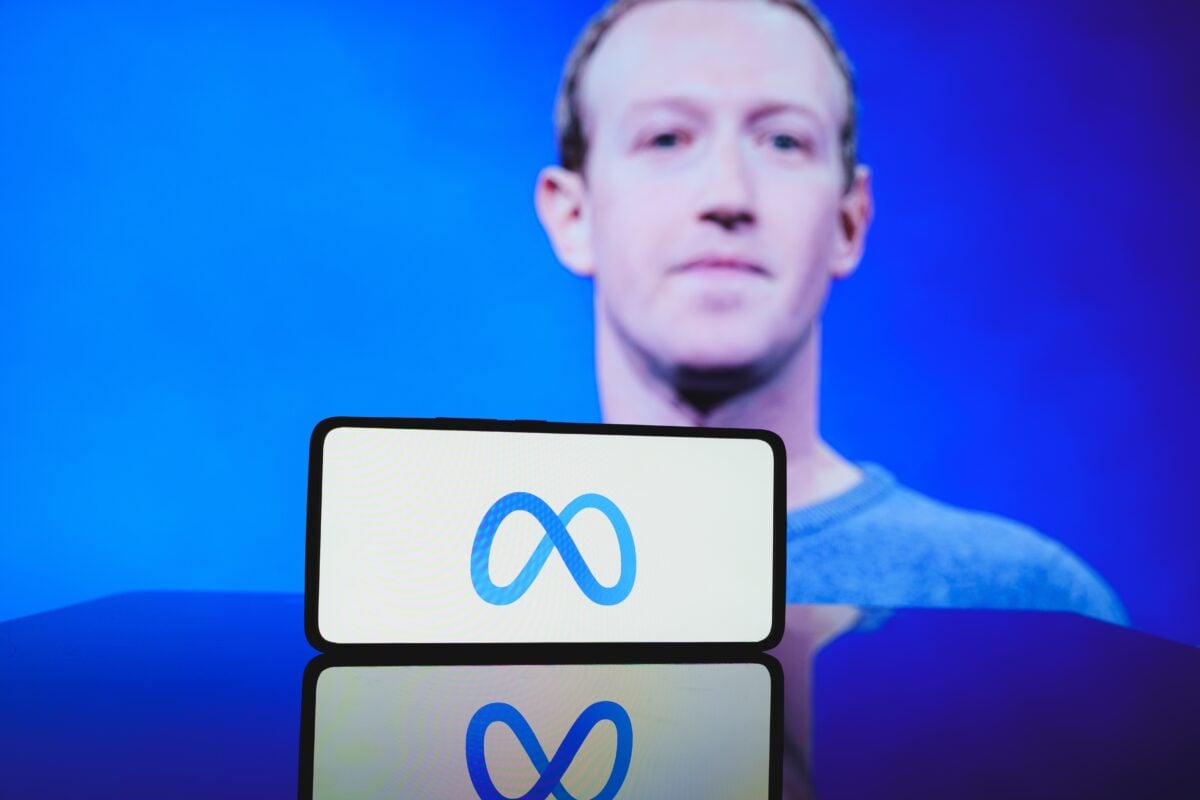

Meta Platforms has reportedly made clear it has no plans to further alter its pay-or-consent advertising framework in Europe, despite facing escalating regulatory threats.

According to sources close to the matter, the company is standing its ground even as the European Commission prepares to impose daily fines for continued non-compliance with the Digital Markets Act (DMA).

The EU fined Meta €200 million in April over its approach to consent for targeted advertising, which regulators argue does not offer users a fair or genuine choice. While Meta made some changes in November 2024 to limit the use of personal data for ads, the Commission has deemed those adjustments insufficient. Beginning June 27, Meta could be fined up to 5% of its global daily revenue for every day it remains non-compliant.

A High-Stakes Gamble Against Regulatory Pressure

Meta’s refusal to budge signals a strategic shift from how it previously handled European privacy rules. In earlier years, the company complied with rulings from regulators in Spain and Ireland after facing multimillion-euro fines. But the current confrontation suggests Meta now sees financial penalties as an acceptable cost compared to the potential disruption of its core data-driven advertising business.

The move represents a direct test of the EU’s regulatory muscle. By choosing to absorb financial penalties instead of conforming further to the DMA’s strict terms, Meta is betting that the impact of changing its business model would be more damaging than repeated sanctions.

Clash Between Business Models and Policy Ideals

At the heart of the dispute is a fundamental disconnect between the EU’s regulatory vision and Meta’s reliance on data to monetize its platforms. The pay-or-consent model gives users a binary choice: agree to tracking for personalized ads or pay a fee for an ad-free experience.

EU officials argue this setup does not constitute freely given consent, viewing it as coercive.

The DMA was designed to rein in the influence of tech “gatekeepers” and promote fairness in digital markets. For the EU, Meta’s approach reflects a business model that undermines both privacy rights and competitive balance. For Meta, the alternative could threaten a core revenue stream. This impasse highlights the broader tensions between innovation, regulation, and fundamental rights in the digital economy.

Enforcement Era Signals New Regulatory Landscape

The Commission’s stance marks a new era in enforcement. Rather than one-off fines, regulators are now preparing to impose rolling financial penalties to ensure continued pressure. Should the daily fines take effect, Meta could face hundreds of millions of euros in losses over time, depending on how long the standoff continues.

This evolving strategy sends a clear message to other tech giants operating in Europe: compliance with the DMA is not optional, and failure to align with its rules could carry sustained financial consequences. The EU’s concurrent actions against other major firms, including Apple, indicate a broader regulatory shift toward faster, more aggressive enforcement.

That said, whether Meta eventually yields or forces a prolonged legal and political showdown may determine the future shape of Europe’s digital economy, and its power to hold Silicon Valley in check.