TLDRs;

Contents

- Ola Electric stock rose 18.36% after unveiling strong FY26 targets, including up to 375,000 EV sales.

- The company expects revenue of up to Rs 4,700 crore and EBITDA margins above 5%, boosted by India’s PLI scheme.

- Ola’s gross margin surged to 25.6% in Q1 FY26 and is projected to hit 40% by year-end.

- Despite rising competition from legacy automakers, investors are encouraged by Ola’s focus on profitability and operational efficiency.

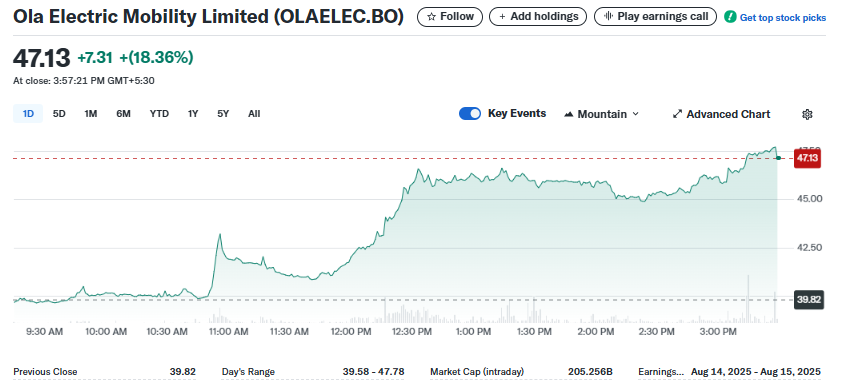

Ola Electric’s stock climbed over just over 18% on July 14, 2025, following the company’s announcement of strong financial and operational projections for the fiscal year 2026.

The share price rose from Rs 39.98 to Rs 47.13, reflecting renewed investor optimism despite the company posting a wider loss in the first quarter of the fiscal year.

Investor Confidence Boosted by FY26 Forecast

The bullish sentiment came after Ola Electric unveiled its aggressive sales goals, targeting between 325,000 and 375,000 electric vehicle units for FY26. Backed by a revenue forecast ranging from Rs 4,200 crore to Rs 4,700 crore, the company’s outlook signaled a rebound strategy focused on profitability and operational efficiency.

Despite reporting a Q1 consolidated loss of Rs 428 crore, a 23% increase from the previous year, investors appeared more focused on Ola’s rising gross margins and positive EBITDA prospects.

PLI Scheme Accelerates Margin Expansion

A major driver of the improved financial picture is the Indian government’s Production Linked Incentive (PLI) scheme. With over Rs 25,000 crore committed to supporting domestic EV and component production, companies like Ola Electric are seeing tangible benefits.

The company projects an EBITDA margin exceeding 5% by the end of FY26, with gross margins expected to reach between 35% and 40%. In Q1 alone, Ola’s margins rose from 13.8% to 25.6%, showcasing the impact of vertical integration and the initial phases of PLI benefits, which are set to kick in more fully from Q2.

While the FY26 outlook appears promising, Ola Electric is contending with growing competition in India’s maturing EV market. Its market share dropped significantly, from 49.2% in 2023 to just 20% as of May 2025.

Legacy automakers like TVS and Bajaj have now surpassed Ola in market presence, leveraging their established supply chains, service networks, and brand reputation.

These dynamics underscore a broader trend where early EV disruptors are increasingly challenged by conventional manufacturers adapting to the electric shift.

Operational Efficiency Becomes Key Metric for Investors

The sharp rise in Ola’s share price, despite rising losses, suggests a shift in investor priorities. Market participants appear to be moving away from evaluating EV firms solely on sales growth, instead emphasizing cost discipline and operational scalability.

Ola’s “Project Lakshya,” a broad internal initiative to streamline production and reduce costs through in-house battery and motor development, is being well-received. Additionally, the company’s healthy liquidity position, with assets of Rs 66.6 billion outpacing liabilities of Rs 35.5 billion, further supports investor confidence in its roadmap to profitability.