TLDRs

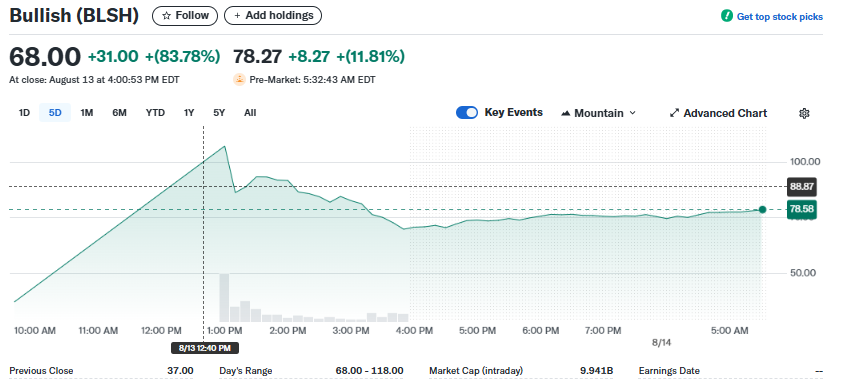

- Bullish’s NYSE debut surges 143%, valuing the Peter Thiel-backed crypto exchange at $13.2 billion.

- Institutional focus drives Bullish’s strategy, contrasting with retail-oriented exchanges like Coinbase.

- The company plans to convert IPO proceeds into stablecoins amid a supportive regulatory environment.

- Bullish’s leadership pedigree and BitLicense pursuit reinforce credibility with institutional clients.

Bullish, a cryptocurrency exchange backed by billionaire investor Peter Thiel, made a stunning entry onto the New York Stock Exchange on Wednesday.

The company’s stock opened at $90 per share, nearly two and a half times its initial public offering price of $37, marking a gain of over 143% on its first day of trading.

Institutional Focus

The IPO places Bullish among the rare U.S.-listed crypto exchanges, following Coinbase’s 2021 debut. Unlike retail-focused exchanges, Bullish targets institutional clients, offering a more stable revenue model.

CEO Tom Farley, a former NYSE president, has emphasized operational discipline and compliance, key factors in attracting institutional investors.

The company is also close to securing a BitLicense in New York, enabling it to operate fully within one of the country’s most tightly regulated markets.

Stability Over Retail Hype

Bullish’s institutional approach reflects lessons from the broader crypto market. Exchanges that rely heavily on retail users, such as Coinbase, face cyclical trading volumes and revenue swings tied to investor sentiment. Bullish, in contrast, focuses on recurring revenues from institutional clients, offering a business model designed for stability.

CEO Farley’s leadership experience and the company’s rigorous compliance framework differentiate Bullish from its retail-oriented peers.

Additionally, Bullish plans to convert a significant portion of its IPO proceeds into stablecoins. This move aligns with emerging regulatory clarity under the GENIUS Act, which established a framework for dollar-pegged cryptocurrencies. The act, coupled with a pro-crypto administration and SEC initiatives to provide clear rules for the market, has created an optimal environment for crypto exchanges to go public.

Industry Leader

The timing of Bullish’s IPO has attracted attention from other major players in the crypto sector. Firms such as Gemini and Grayscale have filed confidentially for U.S. listings, suggesting that Bullish may be leading a wave of institutional-focused crypto IPOs.

Investors are watching closely as the regulatory landscape continues to favor exchanges with strict compliance and operational discipline.

The company’s successful debut underscores the growing appeal of institutional crypto exchanges. By combining regulatory compliance, leadership experience, and a focus on stable revenue streams, Bullish is positioning itself as a reliable player in an evolving market. Analysts suggest that the firm’s valuation and market debut may set a benchmark for future U.S. crypto exchange listings.