TLDRs;

Contents

- AT&T agrees to buy $23B spectrum from EchoStar, expanding 5G coverage across 400 U.S. markets.

- The deal, financed by cash and debt, includes 30 MHz mid-band and 20 MHz low-band spectrum.

- Analysts say the record purchase shows AT&T’s aggressive push to secure spectrum as a growth strategy.

- Unlike its failed T-Mobile merger, this spectrum-only deal is expected to clear regulators with fewer hurdles.

AT&T Inc. (NYSE: T) announced a landmark $23 billion deal to acquire wireless spectrum licenses from EchoStar, a move aimed at significantly boosting its 5G and home internet capabilities.

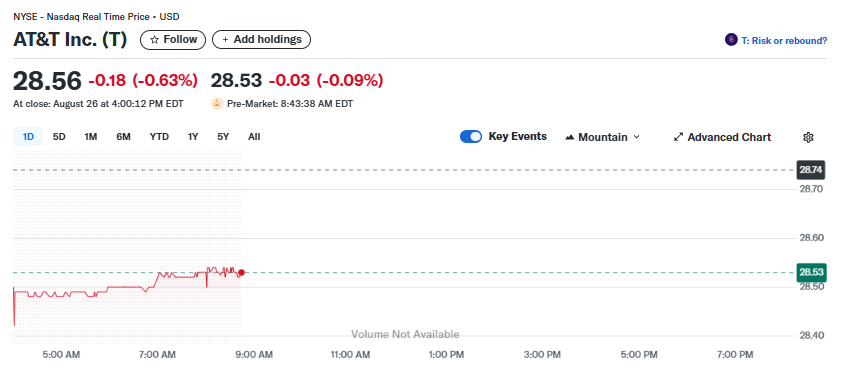

Despite the historic nature of the purchase, shares of AT&T edged lower on Monday, closing at $28.56, down 0.63%, while pre-market trading reflected a further minor dip to $28.53 (-0.09%).

The acquisition will add roughly 50 MHz of spectrum, including 30 MHz in the mid-band (3.45 GHz) and 20 MHz in the low-band (600 MHz). This coverage spans over 400 markets in the U.S., enhancing network performance, capacity, and reach for AT&T’s wireless and broadband services.

Deal Financing and Deployment Timeline

AT&T intends to finance the transaction with a combination of cash reserves and new debt, underscoring the company’s willingness to commit significant resources to its network expansion.

The deal is expected to close by mid-2026, pending regulatory approvals. Once finalized, AT&T plans to deploy the newly acquired spectrum as quickly as possible to stay competitive against Verizon and T-Mobile in the high-stakes 5G race.

Meanwhile, EchoStar will not exit the market entirely. Through an expanded wholesale agreement with AT&T, the company will continue operating as a hybrid mobile network operator under the Boost Mobile brand, maintaining some level of competitive diversity within the U.S. telecom ecosystem.

Escalating Investment in Spectrum Assets

This acquisition highlights AT&T’s escalating investment strategy in network infrastructure. To put the deal in context, the company previously purchased spectrum from Qualcomm in 2010 for just $1.93 billion and acquired NextWave Wireless in 2012 for $25–50 million.

At $23 billion, the EchoStar agreement is more than ten times larger than AT&T’s Qualcomm purchase, signaling the dramatically increasing value of spectrum amid soaring demand for wireless data.

Analysts note that spectrum is no longer a tactical purchase for AT&T but a core growth strategy. With consumer and enterprise data consumption continuing to surge, the company views spectrum as essential to maintaining its competitiveness in the 5G era.

Regulatory Landscape Favors Approval

Unlike AT&T’s failed $39 billion T-Mobile acquisition in 2011, which was blocked by regulators due to concerns about reduced competition, this spectrum-only deal is expected to encounter fewer hurdles.

The 2011 merger attempt would have consolidated customer bases, giving AT&T a 43% market share, something the Department of Justice deemed anti-competitive.

In contrast, the EchoStar transaction doesn’t involve customer acquisition, only spectrum. EchoStar’s ability to continue operating Boost Mobile through AT&T’s network further preserves competition, making regulatory approval far more likely.