TLDRs

Contents

- BlackBerry raises its fiscal 2026 forecast amid a boom in global cybersecurity spending.

- Strong demand for secure communications and adaptive security tools lifts investor confidence.

- Evolving cyber threats are driving enterprise demand despite broader economic pressures.

- The company’s diversification into automotive software continues to offer long-term growth potential.

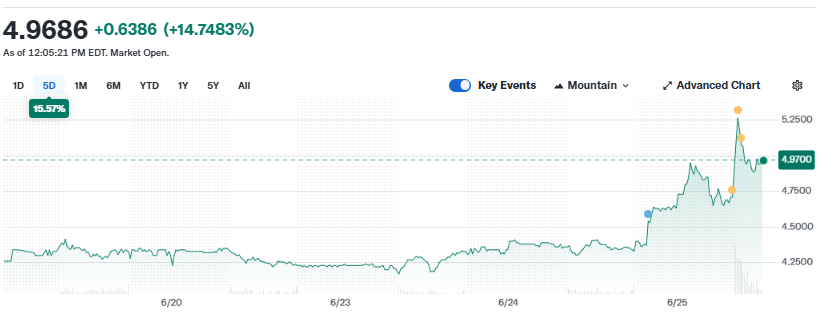

BlackBerry Ltd’s stock soared over 14% on Tuesday afternoon to $4.97, fueled by stronger-than-expected fiscal first-quarter results and an upgraded revenue outlook for fiscal 2026.

The Canadian software company’s improved guidance comes amid a global surge in cybersecurity spending, reinforcing its strategic shift from hardware to digital security and embedded systems. The company now expects to generate between $508 million and $538 million in revenue for the fiscal year, nudging its earlier guidance upward in a move that underscores both internal progress and favorable industry dynamics.

While BlackBerry reported slightly lower first-quarter revenue at $121.7 million, compared to $123.4 million in the same period last year, the company managed to beat expectations on earnings per share, coming in at $0.02 versus projections of zero. The strong performance of its QNX automotive division and a new secure communications deal with the German government helped offset the mild revenue dip.

Cybersecurity Spending Defies Economic Pressures

BlackBerry’s improved forecast aligns with a broader surge in cybersecurity spending across the globe. Amid economic uncertainty, companies and governments continue to treat digital security as non-negotiable. Research shows that 79 percent of businesses plan to expand their cybersecurity budgets in 2025, contributing to a projected 15 percent rise in global cyber spending, which is expected to hit $212 billion next year.

This trend is less about choice and more about necessity. Over half of surveyed organizations have reported security breaches in recent months, signaling that the threat landscape is growing more complex. BlackBerry appears well-positioned to benefit from this reality, particularly through its enterprise-facing security software and communication tools tailored for high-stakes users.

BlackBerry, $BB, Q1-26. Results:

📊 Adj. EPS: $0.02 🟢

💰 Revenue: $121.7M 🟢

📈 Net Income: $1.9M

🔎 Returned to GAAP profitability for the first time since Q4 FY22 and beat guidance across all divisions. pic.twitter.com/wHR8KJpO4g— EarningsTime (@Earnings_Time) June 24, 2025

Evolving Threats Keep Demand High

A key factor behind the industry’s resilience is the rapidly changing nature of cyber threats. Attacks are not only increasing in number but also in sophistication. Recent reports indicate that malware-free breaches now account for 79 percent of detections, with adversaries exploiting gaps in user behavior and system design rather than relying solely on malicious files.

Meanwhile, the average time it takes for attackers to move laterally within a network is now under an hour, with the fastest breaches occurring in under a minute. As organizations scramble to stay ahead of these risks, BlackBerry’s adaptive and AI-integrated security solutions are gaining traction.

Strategic Shift Continues to Bear Fruit

The company’s strategic transformation from a smartphone pioneer to a software-driven security firm is showing tangible results. Its cybersecurity arm now pulls in $285 million in annual recurring revenue, supported by a subscription-based model that offers predictable income and deeper customer relationships.

Cost optimization has also played a critical role. BlackBerry recently trimmed around $150 million in expenses and improved its adjusted EBITDA by $54 million year-over-year. These efficiencies have helped strengthen its balance sheet, even as it faces pressures like negative operating cash flow in the short term.

Diversified Bet on Future Tech

In addition to cybersecurity, BlackBerry maintains a strong foothold in the automotive sector through its QNX operating system, which now powers over 255 million vehicles.

While challenges persist in the automotive supply chain, QNX still boasts a royalty backlog of $865 million, offering the company a buffer as it navigates volatile market cycles.

Looking ahead, BlackBerry’s dual focus on securing digital environments and powering the next generation of vehicles puts it on a solid footing. If global investment trends continue on their current path, fiscal 2026 may well mark a turning point in the company’s long-term resurgence.