TLDR

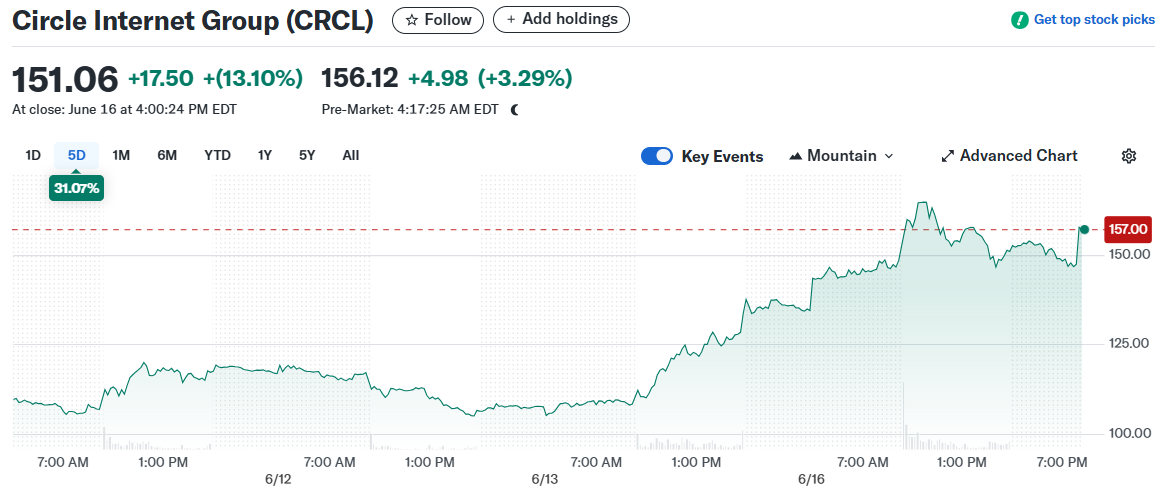

- Circle Internet’s stock price surged following CEO Jeremy Allaire’s comments about stablecoins

- Circle recently completed a successful IPO raising nearly $1.1 billion

- Allaire suggested stablecoins are approaching an “iPhone moment” for mainstream adoption

- The company aims to integrate USDC stablecoin into everyday applications beyond crypto wallets

- Circle’s vision includes enabling instant payments for services like Uber and cross-border commerce

Circle Internet, the company behind the USDC stablecoin, has seen its stock price rally substantially after CEO Jeremy Allaire made comments comparing the future of stablecoins to an “iPhone moment” in tech history. The remarks came during a weekend statement that caught investors’ attention and drove renewed interest in the company that recently went public.

Circle completed its initial public offering (IPO) on June 5, 2025, raising nearly $1.1 billion in an upsized offering that priced above its marketed range. The successful IPO signals growing market acceptance of stablecoin issuers in the financial ecosystem.

Jeremy Allaire’s reference to an “iPhone moment” suggests stablecoins are approaching a tipping point where they transform from niche financial instruments to essential everyday tools. While tech analysts have often overused such terminology when describing new products, Allaire’s statement carries more weight given Circle’s position as one of 2025’s best-performing stocks.

The CEO’s comments specifically pointed to the potential for stablecoins to be integrated into common applications through simple code implementation. This would allow dollar-backed digital currencies to function seamlessly within existing platforms rather than being confined to specialized crypto environments.

Currently, stablecoins like USDC primarily operate within crypto wallets and decentralized finance protocols. However, Circle envisions expanding these use cases dramatically.

https://twitter.com/CryptosR_Us/status/1934879660338208979

Real-World Applications

One potential application highlighted by market observers is the ability to pay for services like Uber instantly upon arrival at a destination. This would eliminate payment delays and processing fees associated with traditional payment methods.

Another use case involves gaming platforms, where players could receive rewards immediately without intermediaries. This direct payment capability could revolutionize how digital economies function within gaming ecosystems.

For e-commerce businesses, the technology could enable faster, cheaper cross-border payments. Merchants could avoid foreign exchange fees and banking delays that currently complicate international commerce.

Market Performance

The enthusiasm around Circle’s future prospects is occurring against the backdrop of a crypto market resurgence. Combined with a recovering IPO market, this has created favorable conditions for Circle’s stock performance.

Circle Internet Financial’s public debut featured CEO Jeremy Allaire ringing the opening bell at the New York Stock Exchange last Thursday. The company’s shares have performed strongly since then, reflecting investor confidence in the stablecoin sector.

The stablecoin market has grown significantly over the past year, with USDC maintaining its position as one of the leading dollar-backed digital currencies. Unlike volatile cryptocurrencies, USDC is designed to maintain a steady value pegged to the US dollar.

Circle’s platform allows developers to integrate digital dollar functionality through relatively simple code implementation. This ease of integration is key to Allaire’s vision of widespread adoption across various applications and services.

The shift from specialized crypto applications to mainstream use represents what Allaire described as the transformation from “nice-to-have” to “can’t-live-without” technology. This pattern mirrors the adoption curve of smartphones following the original iPhone release.

As traditional finance continues to merge with digital asset technology, Circle is positioning itself at the intersection of these trends. The company’s recent stock performance suggests market participants are increasingly buying into this vision.

The most recent trading data shows Circle’s stock continuing its upward momentum following the CEO’s comments, with increased trading volume indicating heightened investor interest in the company’s future.