TLDRs;

Contents

- Tencent’s Q2 revenue rose 15% to $25.7B, driven by gaming growth and AI-powered advertising.

- Domestic and international gaming sales grew 17% and 35%, fueled by hit titles Honor of Kings and Dungeon & Fighter Mobile.

- AI ad services boosted marketing revenue by 20%, reflecting Tencent’s heavy investment in artificial intelligence.

- Shares trade at a discount despite strong fundamentals, with upcoming game launches expected to lift growth further.

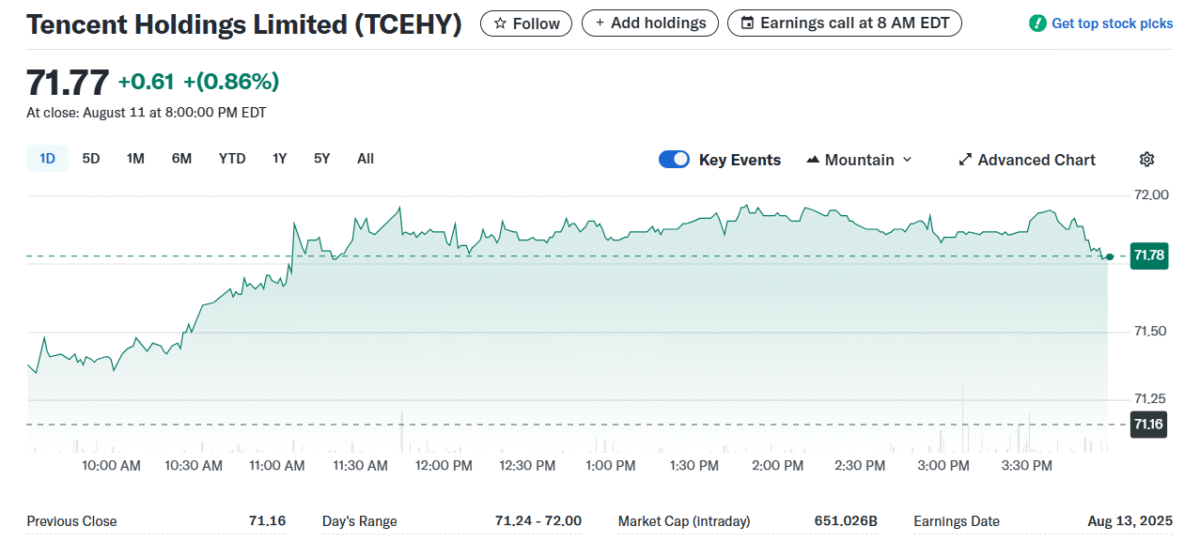

Tencent Holdings Ltd. posted a 15% year-on-year revenue increase in the second quarter of 2025, reaching 184.5 billion yuan (US$25.7 billion) and surpassing analyst expectations.

The performance was fueled by exceptional gaming results and a surge in AI-driven advertising services.

Domestic gaming revenue climbed 17% to 40.4 billion yuan (US$5.6 billion), while international gaming revenue jumped 35% to 18.8 billion yuan (US$2.6 billion). The company credited blockbuster titles like Honor of Kings and Dungeon & Fighter Mobile for the strong performance.

On the advertising front, marketing services revenue surged 20% to 35.8 billion yuan (US$5 billion), boosted by expanded adoption of Tencent’s AI-powered ad targeting and optimization tools. The company’s net profit hit 55.6 billion yuan (US$7.7 billion), also topping forecasts.

Global Gaming Leadership Strengthened

Tencent remains the world’s second-largest gaming company by revenue, with projected 2025 gaming earnings of $25.5 billion. Its international growth is especially significant given its already dominant position, supported by stakes in major studios such as Riot Games and Epic Games.

Honor of Kings alone has generated nearly $14 billion in lifetime revenue, while PUBG Mobile has earned over $9.5 billion. These numbers dwarf the total revenue of many standalone gaming companies, underscoring Tencent’s global reach.

Upcoming launches like Valorant Mobile and Delta Force are expected to bolster gaming sales from late 2025 into 2026, according to Goldman Sachs and other analysts.

AI Ads Drive Marketing Surge

The 20% year-on-year growth in marketing services revenue reflects Tencent’s aggressive push into artificial intelligence.

Capital expenditures for AI initiatives rose 91% compared to last year, enabling the rollout of advanced ad solutions that enhance targeting efficiency and ROI for advertisers.

Tencent’s proprietary AI models, including the Hunyuan-A13B and Hunyuan T1, offer significant efficiency gains over competing systems. These models allow for cost-effective deployment of AI features across Tencent’s vast platforms, positioning the company for long-term scalability without the infrastructure costs faced by pure-play AI firms.

Growth Meets Valuation Gap

Despite adding over US$150 billion in market value in 2024, Tencent’s share price remains 26% below its all-time high. The stock currently trades at 17.6 times forward earnings, cheaper than global peers like Meta, Sony, and Nintendo, and below its five-year average of 20 times.

Analysts suggest the valuation gap stems from lingering investor caution after China’s 2021–2022 regulatory crackdowns. However, with robust earnings, diversified revenue streams, and a pipeline of high-profile game releases, investor sentiment may improve in the coming quarters.