TLDRs;

Contents

- eToro beats Q2 estimates with $0.56 per share in adjusted earnings, above forecasts of $0.50.

- Retail investors rushed into Google, Nvidia, and Tesla during April’s tech stock sell-off.

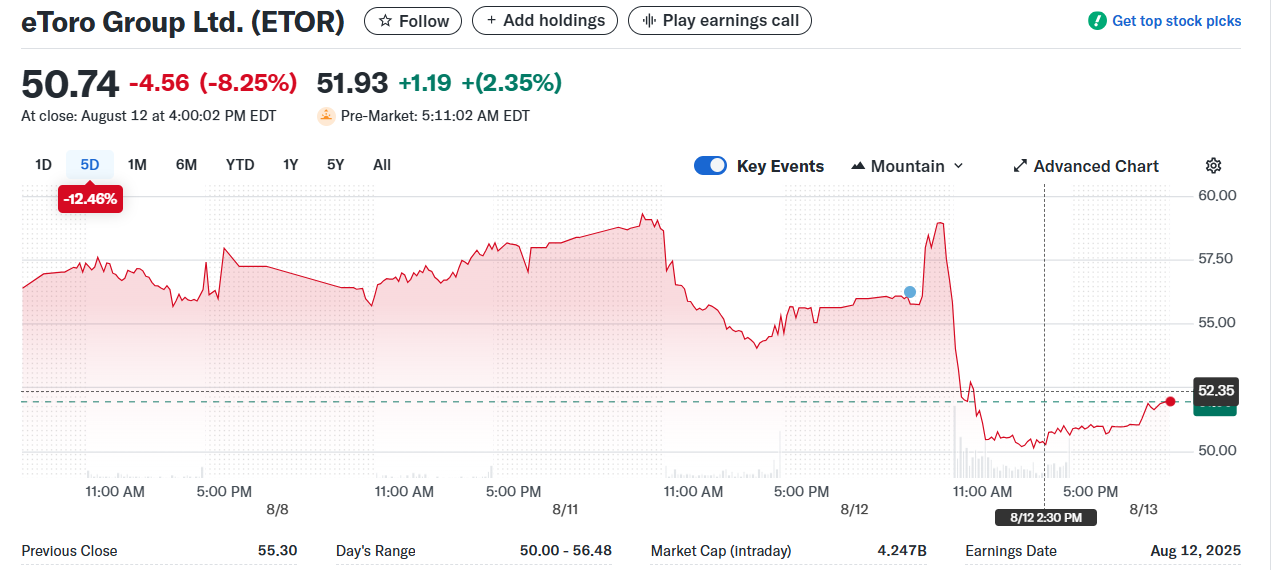

- Despite earnings strength, ETOR closed down 8.25% at $50.74 on August 12.

- July’s crypto trading volumes surged as Bitcoin hit record highs, boosted by regulatory clarity.

Fintech trading platform eToro delivered second-quarter results that outpaced Wall Street expectations, but its stock suffered a sharp decline in the wake of the announcement.

On Tuesday, ETOR closed at $50.74, down 8.25% from the previous session. The results showed adjusted earnings of $0.56 per share, exceeding consensus estimates of $0.50.

The earnings beat was largely driven by a burst of retail buying during April’s market turbulence, when U.S. tariffs triggered a sharp drop in technology stocks.

Rather than retreating, many eToro clients took the opportunity to “buy the dip” in marquee names such as Google parent Alphabet, Nvidia, and Tesla.

The Contrarian Edge in a Volatile Market

eToro CEO Yoni Assia highlighted the willingness of retail traders to go against prevailing market sentiment, a phenomenon supported by historical data. For example, during December 2018’s steep market losses, Wall Street’s worst December since the Great Depression, individual investors who stayed invested or increased exposure were rewarded when the S&P 500 rebounded nearly 8% the following January.

However, market researchers caution that contrarian behavior is not a guaranteed strategy. According to UC Berkeley’s Professor Terrance Odean, retail traders often fall prey to behavioral biases such as overconfidence, performance chasing, and selective attention to popular stocks.

While these biases can sometimes produce quick wins in specific situations, they also risk leading to poor timing and underperformance in other market cycles.

Crypto Momentum Adds Another Growth Lever

Alongside equities, eToro’s cryptocurrency trading volumes surged in July, benefiting from Bitcoin’s push to fresh record highs. Executives said the growth coincided with regulatory developments in the U.S., which have started to provide a clearer framework for digital assets.

Recent policy moves include an executive order from the Trump administration establishing a comprehensive digital asset framework, and the SEC’s “Project Crypto” initiative aimed at modernizing securities rules to accommodate blockchain-based assets. More than 100 policy recommendations are now on the table, spanning market structure, banking integration, and stablecoin oversight.

Assia said the clarity is empowering platforms like eToro to expand their crypto offerings without the uncertainty that has previously slowed mainstream adoption. He also noted that other regulators globally are taking cues from the U.S., suggesting a worldwide trend toward acceptance and integration of digital assets in traditional finance.

Market Reaction Diverges from Fundamentals

Despite delivering both a profit beat and strong engagement from retail traders, eToro’s stock reaction was negative. Shares tumbled sharply after the Q2 report, erasing earlier gains from a mid-quarter rally.

Week 33 Performance of my eToro Portfolio:

🟢 Return YTD: 17.06%

🟢 Return 2Y: 106.38% (since Jan 2023) pic.twitter.com/I0v1c5YKV5— Mariano Pardo (@marian2js) August 11, 2025

Analysts point to several factors that may have contributed to the sell-off including profit-taking after a strong run since eToro’s May U.S. market debut, investor caution over whether retail trading volumes can remain elevated, and broader uncertainty in the fintech sector amid rising competition.

Trading activity, executives said, returned to more typical levels later in the quarter after the April spike. This normalization could have signaled to the market that Q2’s outperformance might not be easily repeated without fresh catalysts.

Still, the company enters the second half of the year with several growth levers inclding a loyal base of retail investors, increasing crypto adoption, and the potential for further expansion into new asset classes.