TLDR

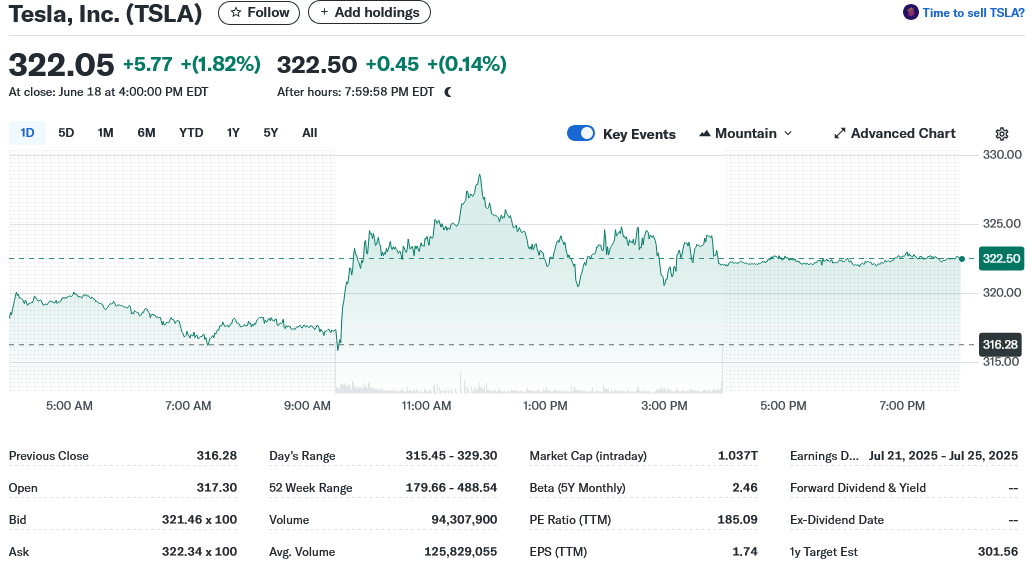

- Tesla stock rose 1.8% to $321.99 on Wednesday ahead of its Austin robotaxi service launch

- The company faces a major “brain drain” with about one-third of executives from two years ago having left

- Tesla’s robotaxi service could leverage the company’s ability to produce 800,000+ vehicles annually in the US

- Musk’s political involvement with DOGE has created consumer and investor concerns

- Stock volatility expected around the robotaxi launch with traders potentially taking profits on 33% gains since April earnings

Tesla stock climbed 1.8% to close at $321.99 on Wednesday as investors await the company’s robotaxi service launch in Austin, Texas. The launch represents a pivotal moment for the electric vehicle maker as it attempts to prove its capabilities extend beyond traditional car manufacturing.

The timing comes as Tesla grapples with internal challenges that could impact its future performance. About one-third of the executives who appeared with Musk at company events two years ago have either left or been removed from their positions.

Recent departures include key leaders in software engineering, battery technology, and humanoid robotics. These exits coincide with mass layoffs that saw tens of thousands of Tesla employees leave the company over the past year.

Musk’s divided attention between Tesla and his role with the Department of Government Efficiency has raised questions among investors and consumers. His political associations have created friction with parts of Tesla’s customer base and may be causing concern among shareholders.

The upcoming robotaxi launch carries both promise and risk for Tesla’s stock price. Zacks stock strategist Andrew Rocco notes that investors need to determine whether they’re trading or investing for the long term.

Trading vs. Investing Considerations

Traders may look to capitalize on Tesla’s 33% gain since the April 22 earnings report. The robotaxi launch presents multiple risk factors including potential delays, technical issues, app problems, or safety incidents.

Short-term volatility around the launch could create opportunities for those comfortable with quick position changes. However, the unpredictable nature of new technology rollouts makes timing difficult.

Long-term investors may view the robotaxi service differently. The technology could demonstrate Tesla’s artificial intelligence capabilities and provide validation for the company’s pivot toward automation services.

Scale Advantage Over Competitors

Tesla’s manufacturing capacity gives it a potential edge over existing robotaxi operators. The company can produce more than 800,000 Model 3 and Y vehicles annually in the United States.

This compares to Waymo, which completes over 250,000 self-driving taxi rides weekly but operates with approximately 1,500 vehicles. Any Tesla vehicle sold in recent years could theoretically join the robotaxi fleet.

The scalability factor appeals to bulls who believe Tesla can rapidly expand its autonomous vehicle presence. Regulatory approval will ultimately determine how quickly the company can deploy additional robotaxis.

Consumer reception of the service will also play a role in determining expansion speed. Early performance in Austin will likely influence investor confidence and stock movement.

Tesla’s ability to execute the launch smoothly becomes crucial given the internal challenges the company faces. The departure of key technical executives raises questions about operational continuity.

Stock performance since the April earnings report suggests investors remain optimistic about Tesla’s technology initiatives. Whether this confidence persists depends on successful execution of the robotaxi program.

Bears remain focused on declining vehicle sales and question whether Tesla deserves credit for robotaxi technology before proving commercial viability. This disagreement between bulls and bears continues to drive stock volatility.

The company’s stock finished Wednesday’s session while the S&P 500 remained essentially flat and the Dow Jones Industrial Average declined 0.1%. Tesla shares have experienced recent fluctuations, dropping 3.9% on Tuesday after gains on Friday and Monday.